CC Global Balanced Income Fund ranks amongst top quartile globally, Sicav suite attracts €11 million in net inflows.

CC Funds SICAV plc, the in-house suite of UCITS funds of Calamatta Cuschieri was established in 2011 and today boasts a 12-year track record with assets in excess of €160 million invested across 11 distinct sub-funds with varying investment objectives.

During 2023 alone, the CC Funds SICAV plc enjoyed net subscriptions of €11 million which translates into new net inflows of over €50 million over the last 3-year period (2021-2023).

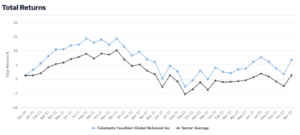

The CC Global Balanced Income Fund ranked in the top quartile of all global funds worldwide in the same category for both the past 3 and 5 years.

(Image source: CityWire Dec20 to Dec23)

As investors continue to warm up to a multi-asset investment approach which includes both bonds and equities alike, the CC Balanced Income Fund continued to gain traction as the size of the fund registered an increase of 62% over the period of January 2022 to December 2023 notwithstanding the various headwinds faced during this time.

Similarly, its performance has been extremely encouraging with the fund returning in excess of 10% year-to-date and a total of 27.2% for the period 31.12.2018 till 20.12.23 due to a large degree to the active management style of the Investment Manager. These numbers compare very favourably with returns observed on similar strategies globally and augur well for the year ahead as the fund is currently well-positioned to benefit from the opportunities which the market is expected to present during the course of 2024.

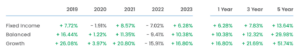

CC Funds Sicav Suite Performance

The challenging market environment witnessed in 2022 has by now been extensively documented. A number of factors, most notably the spillover effects from the COVID pandemic, together with supply chain issues and rampant inflation across the globe contributed to a year that had investors endure negative returns in both bond and equity asset classes alike, something that had not been witnessed since 1969.

CC Funds Sicav Suite Performance. Source: Calamatta Cuschieri Investment Management

The first six months of 2023 was characterised by a volatile environment as market behaviour was very sensitive to the direction which major central banks will take in terms of interest rate trajectory. Sentiment in the bond market was dominated by fears that central banks will maintain their restrictive monetary stance.

More recently, however, financial markets witnessed some impressive comebacks as the much-feared spiralling of inflation appeared to be under the control of central banks thus instilling a new sense of optimism among investors.

Jordan Portelli, Chief Investment Officer said “The interest rate trajectory is now clearer as also indicated recently by major central banks on the back of lower inflation trends. Expectations for 2024 are for a soft landing, with major central banks even looking to cut interest rates at some point next year. This augurs well for fixed-income portfolios as witnessed in recent months as market participants bought into the idea of rates cuts in the near future. Clearly, in terms of market sentiment, expectations of rate cuts are also a positive for the equity asset class and we believe that by adopting a bottom-up approach, value can still be uncovered with attractive expected potential gains.”

Investment Manager Mandates Performance.

The CC Funds SICAV plc is managed by Calamatta Cuschieri Investment Management Limited, which is licenced by the MFSA to provide investment management services to UCITS funds as well as discretionary portfolio management services. A detailed summary of positive performances on the various fixed-income, balanced and growth strategies offered through the wealth management service can be found below. The figures quoted are all after all fees have been deducted.

Discretionary Mandates Strategies Performance Source: Calamatta Cuschieri Investment Management

Stephen Borg, Head of Private Clients commented positive on the performance of the Discretionary Portfolio Management Service, saying that “we have experienced substantial growth and inflows throughout 2023, reflecting clients’ increasing reliance on professional advice, amid the market volatility witnessed in recent years. Our various strategies have attracted a growing number of investors seeking professional management of their portfolios”

“Notably, our portfolios have demonstrated robust performance, ranging from over 6% in pure fixed income portfolios to around 17% in equity mandates. The positive results have translated into an encouraging pipeline of new clients into the new year, underscoring the demand for our expertise services in guiding them through the challenges of the financial landscape.

About Calamatta Cuschieri Investment Services

Besides CC Funds Sicav plc, Calamatta Cuschieri also offers a wide spectrum of investment solutions and manages a total of €1.5 Billion in Assets Under Management. These include direct equities, other international funds, Eurobonds and assets listed on the Malta Stock Exchange.

Calamatta Cuschieri was established in 1971 where it pioneered the local financial services industry and has grown from strength to strength with a reputation of offering unbiased and professional investment advice together with innovative technology which are backed by ISO9001 certification on customer care.